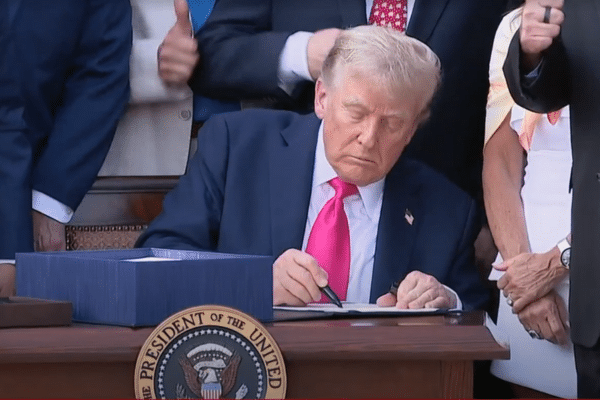

At a signing ceremony at the White House on Friday, President Trump signed into law a sweeping $3.4 trillion tax and spending bill known as the “One Big Beautiful Bill Act.” Critically, the package does not directly impact Medicaid assisted living programs, but does include Argentum-supported tax measures to help more seniors afford long-term care and to help workers invest in career development programs.

At a signing ceremony at the White House on Friday, President Trump signed into law a sweeping $3.4 trillion tax and spending bill known as the “One Big Beautiful Bill Act.” Critically, the package does not directly impact Medicaid assisted living programs, but does include Argentum-supported tax measures to help more seniors afford long-term care and to help workers invest in career development programs.

The package was signed into law on July 4, meeting the internal deadline set by the administration. The House had voted 218-214 the day prior on Thursday to pass the bill the Senate voted 51-50 on Tuesday, with Vice President J.D. Vance cast the tie-breaking vote. Only two House Republicans and three Senate Republicans voted against the package: Representatives Thomas Massie (R-KY) and Brian Fitzpatrick (R-PA), and Senators Rand Paul (R-KY), Thom Tillis (R-NC), and Susan Collins (R-ME). Senator Lisa Murkowski (R-AK) made a late decision to support the package, despite conceding it was a “bad bill,” after winning numerous concessions from Republican leadership and with the expectation that the House would change it and send it back for further negotiations.

Most importantly, the legislation does not directly impact Medicaid assisted living programs. Argentum has actively advocated against any cuts to Medicaid assisted living and successfully defeated reductions to the Federal Medical Assistance Percentage (FMAP), which could have drastically reduced Medicaid spending and potentially impacted assisted living. As the legislation is implemented, Argentum will be working directly with our State Partners to ensure that state-level reforms do not impact assisted living programs or participants.

The final package also includes a temporary tax deduction for seniors of $6,000 for individuals and $12,000 for couples (the deduction is set to expire in 2028). The deduction phases out beginning at $75,000 ($150,000 for couples) and completely at $175,000 ($250,000 for couples). While this measure is not the targeted long-term care tax credit Argentum sought, it will help to offset some long-term care expenses to increase access and affordability of care. We will continue to advocate for the bipartisan Credit for Caring Act (H.R. 2036 and S. 925) to provide a $5,000 tax credit specific for long-term care expenses as a separate measure this Congress.

Argentum also worked with a broad coalition to successfully secure a measure to allow tax-exempt distributions from 529 savings plans to be used for workforce development purposes, including credentialing programs. Argentum has advocated for this concept through the Freedom to Invest in Tomorrow’s Workforce Act (H.R. 1151 & S. 756) to help senior living workers seeking to advance their career through various credentialing programs.

Other notable provisions of the legislation include:

- $4.5 trillion in tax cuts and $1.2 trillion in spending reductions, along with a $5 trillion increase to the debt ceiling.

- Nearly $1 trillion in Medicaid reductions, including new work requirements, called “community engagement requirements,” starting January 1, 2027, for people 19-64 with certain exceptions, along with new co-payments, and limits on federal reimbursements to states.

- Prohibits states that have not expanded Medicaid from establishing new provider taxes and freezes any provider taxes currently in place at current rates. Reduces safe harbor threshold for provider taxes for expansion states by 0.5% every year starting in 2028 until the maximum safe harbor threshold reaches 3.5% in 2032.

- $50 billion rural provider relief fund for certain provider types located in rural areas.

- 12% permanent expansion of the low-income housing tax credit (LIHTC).

- Moratorium on implementing portions of the nursing home staffing rule that have not yet gone into effect, including minimum staffing requirements.

- Permanently allows the business interest deduction to be calculated based on EBITDA instead of EBIT.

- Makes 100% bonus depreciation permanent for certain property, including most machinery and factories.

- An increase in the state and local tax (SALT) deduction cap from $10,000 to $40,000 for five years, which would then revert to the current $10,000 limit.

- No tax on tipped income up to $25,000 per individual through 2028; this starts to phase out for individuals making at least $150,000.

- No tax on overtime pay up to $12,500 for individuals and $25,000 for joint filers through 2028. Starts to phase out for individuals making at least $150,000.

- The elimination or phase-out of most clean energy tax credits established by the Inflation Reduction Act.

- Significant funding increases for the DOD, ICE, CBP, and DOJ for interior immigration enforcement, deportation, and border security.