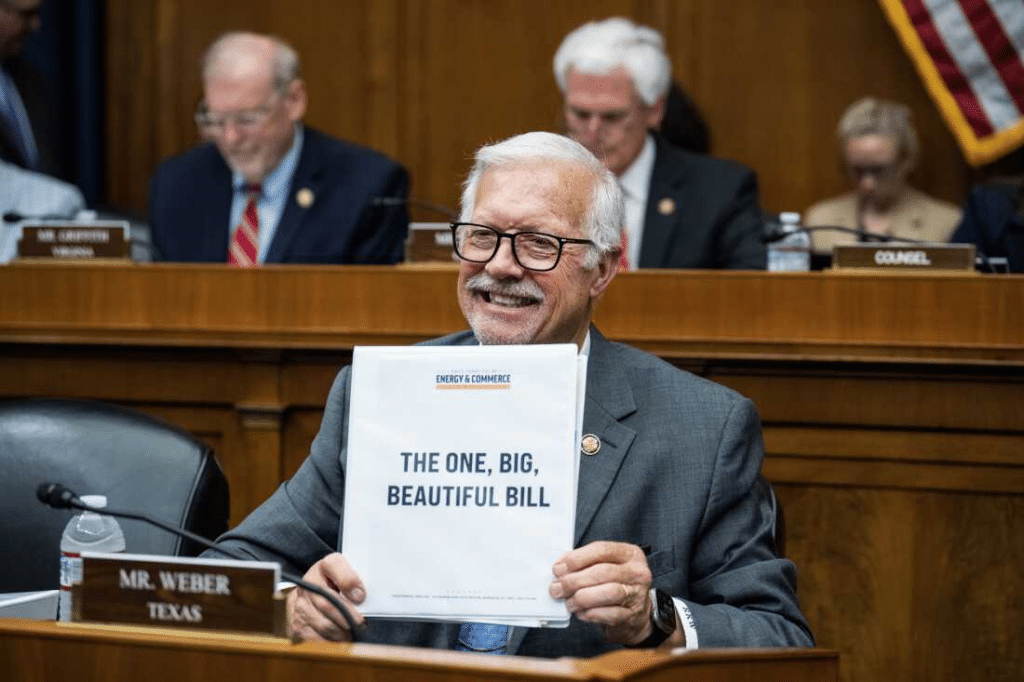

The U.S. Senate is now able to formally begin the process of considering H.R. 1, the One Big Beautiful Bill Act, after the House passed it in May by a vote of 215-214. Last week, the House voted 213-207 on a procedural measure to remove several items from the package that were not compliant with Senate rules, including oversight of the employee retention tax credit, and defense and intelligence spending that were noncompliant with the legislation.

The U.S. Senate is now able to formally begin the process of considering H.R. 1, the One Big Beautiful Bill Act, after the House passed it in May by a vote of 215-214. Last week, the House voted 213-207 on a procedural measure to remove several items from the package that were not compliant with Senate rules, including oversight of the employee retention tax credit, and defense and intelligence spending that were noncompliant with the legislation.

Senate Republicans are preparing sweeping changes to the House-passed package, with Senator Ted Cruz (R-TX), the chair of the Senate Commerce Committee, indicating that the Senate’s version is likely to be in-line with roughly 60% of the House-passed version, leaving significant need for consensus between the two chambers. Senate Finance Committee Chair Mike Crapo (R-ID) outlined plans to revise key tax provisions, including the $40,000 cap on the state and local tax (SALT) deduction negotiated by several House Republicans who have cautioned against changes to the agreement. Crapo has also indicated he plans to review Medicaid provider taxes and the phaseout of Inflation Reduction Act (IRA) clean energy credits, threatening the support of many lawmakers who are pushing for drastic federal spending cuts.

Republican lawmakers and the White House had set an internal deadline of passing the package by July 4; however, this deadline is non-binding. The only binding deadline for budget reconciliation is that it must be passed in that fiscal year, meaning the FY 2025 package that is being used for the One Big Beautiful Bill Act, must be passed no later than September 30, 2025. A separate budget reconciliation package would be available for FY 2026, beginning on October 1. Senate Majority Leader John Thune (R-SD) has suggested delaying or cancelling the planned July 4 recess to continue working on the reconciliation package if not passed by their internal deadline. Several Senate committees are expected to release the legislative text of their portions of the package this week.

Argentum’s priorities in this process remain preventing potential cuts to Medicaid assisted living and to advance tax credits to help more Americans access and afford long-term care, such as the Credit for Caring Act (H.R. 2036 and S. 925), which would provide a $5,000 tax credit for long-term care expenses.